Beyond China: Nations Diversifying Manufacturing Destinations

- Mr. Vikram Kotak

Amidst escalating tensions between the United States and China, compounded by the tumultuous trade war and strained relations under the Trump administration, China finds itself increasingly sidelined as the preferred choice for American businesses. The lingering discord between the two economic giants has prompted many companies to seek alternatives to minimize risks and ensure stability in their supply chains. Furthermore, in the wake of persistent economic hurdles, particularly in China's real estate domain, businesses are reassessing the country's role as a primary manufacturing hub. This shift has sparked interest in the "China plus one" approach among companies seeking to broaden their horizons and mitigate risks associated with overreliance on a single market.

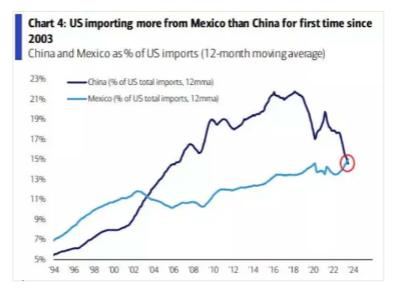

The concept of an alternative to China emerged as a strategic response to the volatile U.S.- China relations, prompting American companies to seek alternative manufacturing bases. This shift gained momentum as the Biden administration advocated for "friendshoring," encouraging diversification among allied nations to mitigate geopolitical risks. Mexico emerged as the standout beneficiary, notably surpassing China to become the leading exporter to the U.S. in 2023, while India, Vietnam, and other countries also experienced gains. Mexico exported $475.6 billion to the U.S. Mexico's exports to the U.S. surpassed China's for the first time in 20 years. The U.S. imported a total of $427.2 billion from China last year, a roughly 20% decrease from the year before.

American businesses, wary of supply chain vulnerabilities, turned to Southeast Asia due to its stability and proximity to China. President Biden highlighted Vietnam as a promising partner for semiconductor production, while Singapore and Malaysia attracted attention from U.S. firms.

Simultaneously, Chinese companies also diversified their supply chains to mitigate geopolitical risks, expanding operations to Southeast Asia, Africa, and even the U.S. Consequently, America's trade deficit with Mexico grew, while its deficit with China decreased notably.

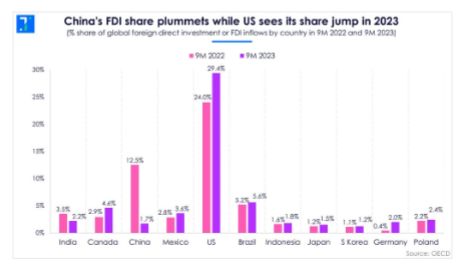

As highlighted in the graph, China has lost global FDI share, while the US has gained. Other countries that saw their FDI share increase are Canada, Japan, South Korea, Mexico, and Poland. Meanwhile, India's share in global FDI fell to a six-year low.

The fall was confounding, given the economy's rapid growth, and increasing share in global trade. Several developing countries have witnessed fall in FDI flows.

Trade agreements have played a pivotal role in pecking order. Mexico's advantageous position was bolstered by trade agreements granting free tariffs, further incentivizing American companies to prioritize Mexico over other countries. This, coupled with a stable supply chain, solidified Mexico's position as a preferred destination.

Subsequently, Asia remains on the right trajectory, leveraging its strengths in sectors like Electronics Manufacturing Services (EMS). Examples such as the establishment of an Apple factory in Asia underscore its potential as a viable alternative to China. Moreover, Asia's participation in trade agreements and efforts to enhance its infrastructure and business environment could further enhance its appeal to American companies seeking to diversify their supply chains.

Factors owing to the US preferring Mexico over Asia:

Proximity and Logistics:

Geographical proximity to the United States provides logistical advantages, facilitating faster shipping times and reducing transportation costs compared to distant manufacturing locations. This is advantageous for industries requiring just-in-time manufacturing and quick turnaround times.

Closely Monitored by the US:

Given the strategic importance of the US-Mexico relationship, the proximity allows for closer monitoring and easier oversight of supply chains, aligning with American interests in security and regulatory compliance.Cost Structure:

Despite Asia's cost advantages in terms of labour, Mexico's overall cost structure, including factors like infrastructure, regulatory environment, and ease of doing business, often outweighs Asia's advantages. Hence Mexico is a more attractive destination for companies seeking cost efficiency without compromising quality.Infrastructure:

Asia still grapples with infrastructural challenges such as inadequate transportation networks, power shortages, and bureaucratic hurdles, which can impede the smooth functioning of supply chains and increase operational costs.Meanwhile, Mexico's infrastructure ranks 7 th in Latin America, behind Barbados, Chile, Panama, Jamaica, El Salvador and Uruguay. In recent years, infrastructure has been a top priority for the Mexican government. In 2019, Mexico announced a $44 million infrastructure plan, focusing on transportation, IT, and energy to boost manufacturing. This has made Mexico a top destination for business process outsourcing and manufacturing. With 16 major ports, extensive railway connections, and over 2,000 airports, Mexico offers easy access to global markets.

Additionally, technology investments ensure high-speed broadband and meet U.S. standards, enhancing its competitiveness

In essence, while Mexico has become the primary alternative to China, leveraging advantageous trade agreements and stability, India's future is promising, buoyed by sector- specific strengths and ongoing efforts to improve its business ecosystem. Both countries exemplify the evolving landscape of global supply chains amidst geopolitical tensions, with each offering unique advantages to American businesses seeking resilience and flexibility.

India's Path Forward

The areas where India can focus to leverage China's falling position as a manufacturing hub:

Investment in Infrastructure:

Improving infrastructure, including transportation networks, power supply, and digital connectivity, is essential to reduce logistical bottlenecks and enhance operational efficiency.Policy Reforms:

Streamlining regulatory procedures, reducing bureaucratic red tape, and enhancing ease of doing business can make India a more attractive destination for foreign investment.Tax Benefits:

Since 2018 China has lured corporates by reducing corporate income tax from 25% to 15% for high and new tech enterprises. Today, almost 60% of Chinese companies have tax rates below 15%. In addition, 200% pre-tax super deduction of research and development expenditure was granted to these strategic industries in 2022. These industries got red carpet in their dividend payout policies as well. India needs to replicate this model soon, needs more tax and R&D breaks and a consistent GST process that will place India in a level playing field.Sector-specific Initiatives:

Focusing on sectors where India holds a competitive advantage, such as technology, pharmaceuticals, and renewable energy, can attract foreign investment and drive economic growth.Skill Development:

The interim budget for 2024-2025 allocated ₹1.2 lakh crore to the education sector in India, with ₹47,619.77 crore set aside for the Higher Education Department. The interim budget for 2024-2025 allocates Rs 538 crore for the Capacity Building and Skill Development Scheme. Investing in education and skill development programs to enhance the quality of the workforce can ensure a steady supply of skilled labour, addressing concerns about productivity and quality.

In conclusion, Mexico's ascendancy as a favoured manufacturing hub in the "China Plus One" strategy emphasizes its geographical advantage, cost-effectiveness, and logistical convenience. However, India stands poised to surpass Mexico and become the ultimate choice for manufacturers. By tackling infrastructural hurdles, enacting policy reforms, and leveraging its inherent strengths, India can position itself as the premier destination for manufacturing and investments in the evolving global landscape.